When you think about diversifying your financial strategy, you probably picture stocks, bonds, real estate, or retirement accounts. But have you thought about how diversification can also strengthen your Indexed Universal Life (IUL) policy? Whether you’re new to IULs or already own one, using a mix of index strategies can help your policy support your broader financial goals.

Think of it like packing for a trip. You wouldn’t bring just one outfit. You’d prepare for all kinds of weather. Diversifying your IUL works the same way. Instead of relying on a single index, you can spread your money across different strategies to help smooth out performance over time and protect your cash value when markets dip.

An IUL is a flexible financial tool that can grow tax-free cash value, protect against losses due to market volatility during market downturns, and provide IUL benefits like an income-tax-free transfer of wealth to your loved ones. And like any part of your financial plan, it works best when it’s supported by wise, diversified choices.

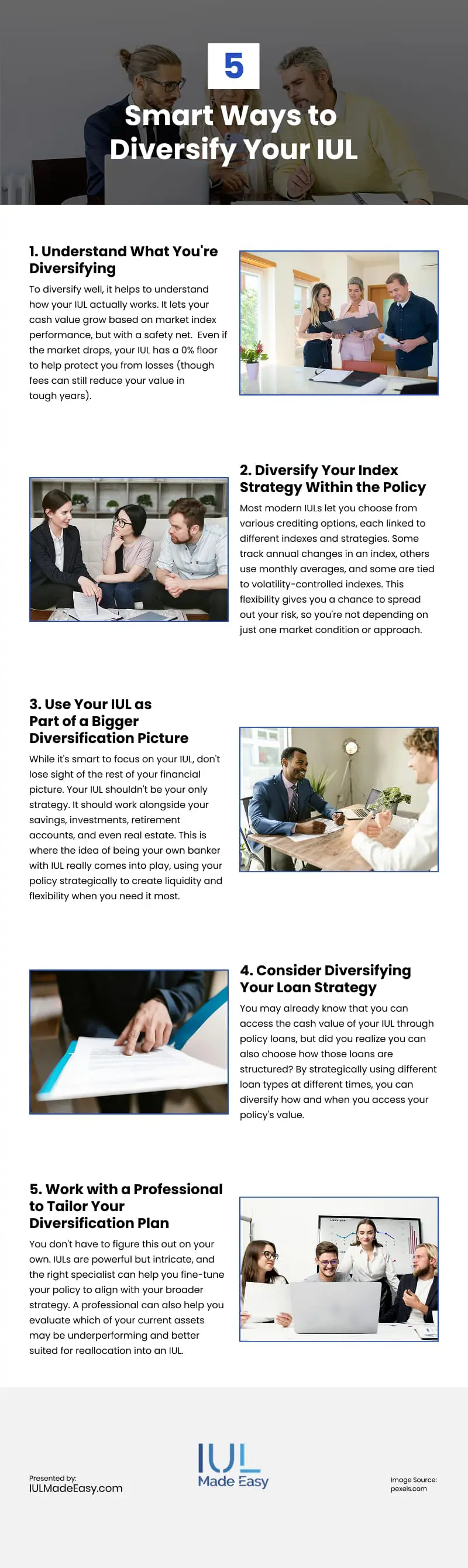

How to Diversify Your IUL

Let’s walk through how to diversify both inside and around your IUL, so you can strengthen your approach, manage risk, and build a more adaptive financial future.

1. Understand What You’re Diversifying

To diversify well, it helps to understand how your IUL actually works. It lets your cash value grow based on market index performance, but with a safety net. Even if the market drops, your IUL has a 0% floor to help protect you from losses (though fees can still reduce your value in tough years).

Keep in mind, you’re typically not earning the full market return. Most index strategies have caps or limits on how much you can gain, and your growth also depends on your participation rate. So, while there’s growth potential, it’s not guaranteed.

By understanding these mechanics, you’re better positioned to integrate your IUL with other financial strategies to manage risk and pursue sustainable long-term results.

2. Diversify Your Index Strategy Within the Policy

Most modern IULs let you choose from various crediting options, each linked to different indexes and strategies. Some track annual changes in an index, others use monthly averages, and some are tied to volatility-controlled indexes. This flexibility gives you a chance to spread out your risk, so you’re not depending on just one market condition or approach.

For example, one strategy might be linked to the S&P 500 with a 9% cap, while another uses a volatility-managed index with no cap but only credits 60% of the gains. Blending these strategies can help bring more balance to your policy. It’s like diversifying inside your IUL—you’re not putting all your eggs in one basket.

While returns aren’t guaranteed, using a mix of crediting strategies can give your policy more chances to earn steady interest, whether the market is up, down, or somewhere in between.

3. Use Your IUL as Part of a Bigger Diversification Picture

While it’s smart to focus on your IUL, don’t lose sight of the rest of your financial picture. Your IUL shouldn’t be your only strategy. It should work alongside your savings, investments, retirement accounts, and even real estate.

For example, when the market is down and you need liquid funds, you might use your IUL as a backup source of funds, taking a tax-free loan instead of tapping your 401(k) or selling stocks at a loss. Since IUL loans aren’t withdrawals (you’re actually just using the capital as collateral), they generally stay tax-free as long as the policy stays active. That gives you a flexible option to help manage risk without disrupting your long-term plans.

In strong market years, you can keep your IUL’s cash value growing based on your chosen index strategies. It’s a way to stay balanced, have a cushion during downtime, and have growth potential when things are up.

This is where the idea of being your own banker with IUL really comes into play, using your policy strategically to create liquidity and flexibility when you need it most.

4. Consider Diversifying Your Loan Strategy

You may already know that you can access the cash value of your IUL through policy loans, but did you realize you can also choose how those loans are structured? Most providers offer Zero Wash Loans, where the interest you’re charged is equivalent to the guaranteed interest you earn. They also often offer Index Loans (also called Alternate Loans), where the interest charged is higher, but your borrowed funds still have the opportunity to grow based on your indexing strategies—unless the market underperforms, in which case the credited rate is 0%.

By strategically using different loan types at different times, you can diversify how and when you access your policy’s value. For example, during steady market years, you may lean on Index Loans to give your borrowed funds a shot at growth. In more volatile years, a Zero Wash Loan might make more sense to minimize risk.

This kind of planning allows you to preserve the long-term benefit of your policy while still enjoying the short-term flexibility that loans provide. Just remember that policy fees apply every year, and those fees can reduce your cash value even when credited interest is 0% due to market volatility.

5. Work with a Professional to Tailor Your Diversification Plan

You don’t have to figure this out on your own. IULs are powerful but intricate, and the right specialist can help you fine-tune your policy to align with your broader strategy. That includes selecting the right index crediting methods, funding schedule, and loan provisions, all of which can vary by provider.

A professional can also help you evaluate which of your current assets may be underperforming and better suited for reallocation into an IUL. For example, if you’re holding a large cash reserve in a low-interest savings account, those funds may be a better fit inside a LASER Fund (a properly structured, maximum-funded IUL designed to offer Liquid Assets Safely Earning Returns).

By making these decisions thoughtfully, you give yourself the ability to build a strategy that’s not only diversified but also adaptive. You’re not locking yourself into a rigid system—you’re creating something you can shape and evolve over time.

Part of the Plan

Your Indexed Universal Life policy is a flexible tool that can be even more effective when it’s part of a well-diversified financial plan. Whether you’re managing risk, building cash value, or planning for the future, smart diversification helps your IUL work harder for you.

By mixing crediting strategies, coordinating with other assets, and using policy loans wisely, you can create a more stable and adaptable financial approach.

Ready to make the most of your IUL? Don’t go it alone. A knowledgeable IUL specialist can help tailor a strategy that fits your goals and grows with you, one smart move at a time.

Video

Infographic

An Indexed Universal Life (IUL) policy is a flexible financial tool that provides tax-free cash growth, market downturn protection, and allows for income-tax-free wealth transfer to loved ones. Check out this infographic for five smart ways to diversify your IUL.