You’ve heard of life insurance—that reassuring sum that pays out a death benefit to your beneficiaries when you die. It’s critical for many families since it can help keep them financially stable when a loved one passes away.

Indexed universal life insurance, or IUL, is one type that can give you that peace of mind. But with an IUL, your insurance can grow money, too.

Have you ever wanted to set aside money that can grow but doesn’t go “poof” when the market takes a dip? IUL insurance may be the right choice for you.

IUL offers life coverage and has the potential to build cash value over time. It’s a hybrid—part insurance, part “safe” vehicle for growth.

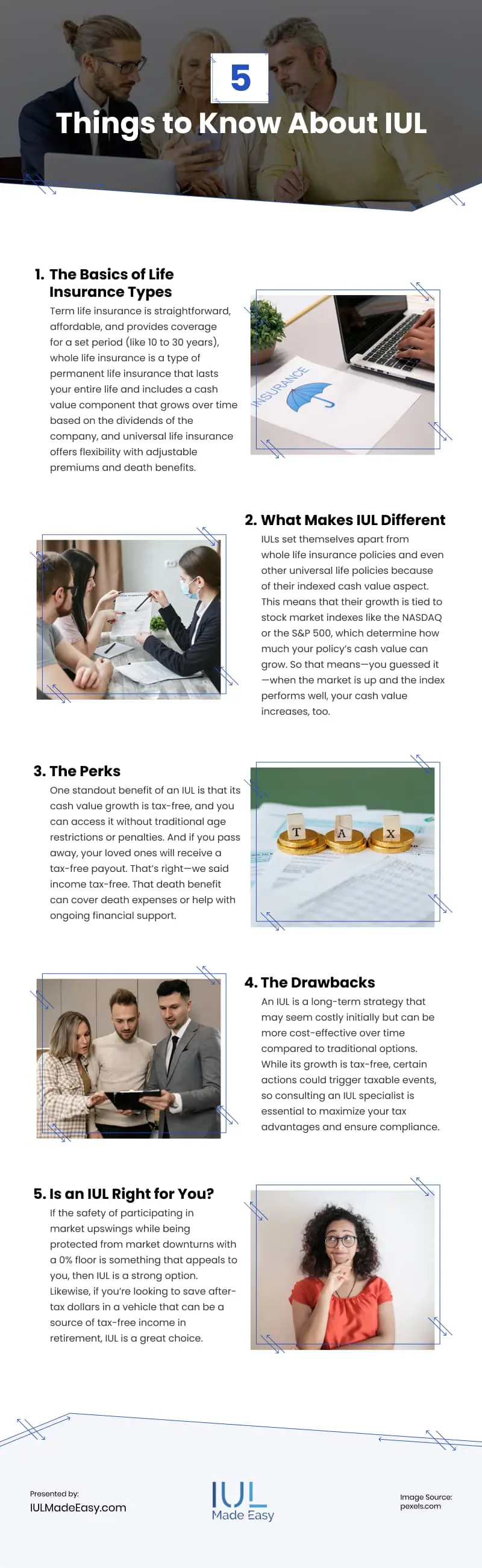

The Basics of Life Insurance Types

You have so many options to pick from when it comes to life insurance, so let’s break down the main three types.

Term Life Insurance

Term life insurance is straightforward and affordable and provides coverage for a set period, like 10 to 30 years. Unlike whole or universal life, term life has no cash value and only pays a death benefit if you pass away during the term.

Once the term ends, coverage expires unless renewed, making it ideal for those who want lower-cost, temporary coverage rather than a lifetime policy with a savings component.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that lasts your entire life and includes a cash value component that grows over time based on the dividends of the company. Part of your premium goes toward building this cash value, which you can borrow from or use as savings.

Whole life guarantees a consistent premium over the course of your “whole life,” so whenever you pass away, your family gets a nice death benefit.

Universal Life Insurance

Universal life insurance offers the flexibility that other types don’t, with adjustable premiums and death benefits.

Its cash value grows based on market rates, allowing you to occasionally skip payments if your cash value is high enough. This makes it a great choice for those wanting lifetime coverage with more control.

Ultimately, which policy is “just right” for you depends on your goals: what protection do you need, for how long, and do you want tax-advantaged growth and tax-free income?

What Makes IUL Different

IULs set themselves apart from whole life insurance policies and even other universal life policies because of their indexed cash value aspect.

This means that their growth is tied to stock market indexes like the NASDAQ or the S&P 500, which determine how much your policy’s cash value can grow. So that means—you guessed it—when the market is up and the index performs well, your cash value increases, too.

You may think, “What about when the market dips or crashes?” We have good news—unlike direct market investments, your policy won’t lose value due to market volatility when an index drops out of the blue. So, if market volatility stresses you out, IUL’s built-in guardrails might bring some peace.

But hold your horses—even if the market is really good, many index strategies have a cap on how much you can earn, so the gains you could find from all your good luck do have a limit.

Note that there are some index strategies with no cap that can provide huge upsides during growth years. No cap strategies do have a threshold/spread, which is a rate the insurance company subtracts from indexed account growth. It can change depending on the market, and is typically between 5% and 15%.

You can think of IUL insurance policies as the children’s roller coaster rides of investments: you get some fun highs without the scary drops.

The Perks

Perhaps the most notable benefit of an IUL is that the money you earn is tax-free. Any cash value growth is yours to keep—Uncle Sam has to leave it be in most cases.

Plus, IULs offer you the ability to access your money tax-free without being hampered by traditional accounts’ age restrictions or penalties. No need to celebrate your 59½ birthday to avoid a 10% penalty.

With a traditional retirement account like an IRA or 401(k), there’s an annual contribution limit. IULs don’t have the same contribution limits. You can contribute millions of dollars in a given year based on your policy design.

And if you pass away, your loved ones will receive a tax-free payout. That’s right—we said income tax-free. That death benefit can cover death expenses or help with ongoing financial support.

The Drawbacks

IUL is a long-term strategy, not a short-term game. It can come with perceived high costs, however, when looked at with an analytical eye, over the life of the policy it can be more cost-effective than other traditional solutions.

To reiterate, growth is tax-free in the IUL, but there are things that might trigger the IRS to treat the withdrawn amount as taxable income. Because of this, it is wise to work closely with an IUL specialist to ensure you optimize your tax advantages.

Is an IUL Right for You?

If the safety of participating in market upswings while being protected from market downturns with a 0% floor is something that appeals to you, then IUL is a strong option. Likewise, if you’re looking to save after-tax dollars in a vehicle that can be a source of tax-free income in retirement, IUL is a great choice.

For people looking for life insurance and retirement options, an IUL could be ideal. Many people who choose IUL have a significant amount to set aside within five to 10 years, but it’s even possible to start younger and set aside as little as $500 a month in an IUL over a few decades.

(freepik/Freepik)

That said, if you’re just starting to save your money, you might consider traditional alternatives like IRAs or 401(k)s, which are easier to manage on your own, may have lower fees, and utilize pre-tax dollars.

And with 401(k)s, you have the advantage of employer-matching to help boost your savings. Keep in mind, however, that the money you withdraw from these vehicles will be taxed on the gains (and if you access the money before age 59 ½, you’ll likely be hit with a 10% penalty as well).

The bottom line is that an IUL is like the Swiss Army knife of life insurance. It does a lot but isn’t necessarily for everyone, so be sure to make your plan with your situation and goals in mind to help you reach the financial peace of mind you crave.

Infographic

Do you want to grow your money without losing it in a market dip? Indexed Universal Life (IUL) insurance could be the solution. It offers life coverage and potential cash value growth, combining insurance with a safe investment option. Read on to learn more in this infographic.