Taxes are like that person who shows up to the party uninvited. You can’t avoid them, but you have some control over how much they affect your finances.

Indexed universal life (IUL) insurance offers a clever way to grow your money with minimal tax interference. It provides life insurance protection for your loved ones while allowing your cash value to increase tax-deferred.

How does the IRS fit into all of this? As long as you play by the rules, it’s a mostly friendly relationship. Let’s take a closer look at how you can plan your IUL tax-free retirement.

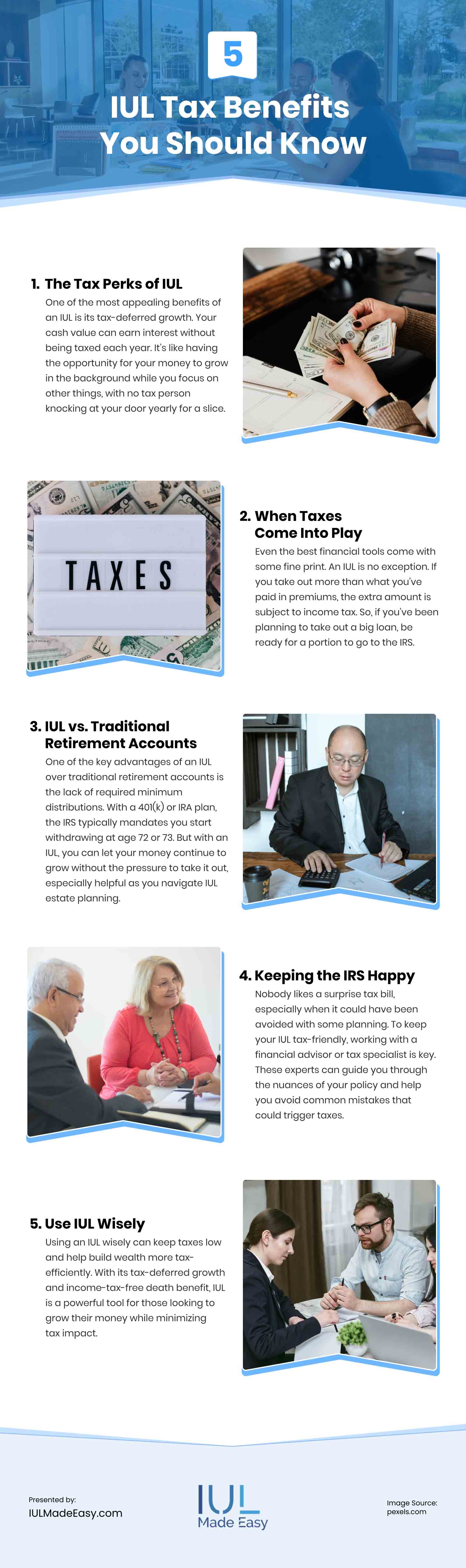

The Tax Perks of IUL

One of the most appealing benefits of an IUL is its tax-deferred growth. Your cash value can earn interest without being taxed each year. It’s like having the opportunity for your money to grow in the background while you focus on other things, with no tax person knocking at your door yearly for a slice.

Another perk? Unlike 401(k)s or IRAs, there are usually no contribution limits. You can contribute as much as you want, subject to the policy’s guidelines, equipping you with the potential to save more over time. This flexibility gives you the freedom to accelerate your savings.

Need quick access to cash? You can typically borrow against your IUL without paying taxes upfront as long as you keep the loan manageable, yet another cash-value life insurance tax benefit. However, taxes may be due if the loan grows too large or the policy lapses.

Lastly, the death benefit is paid out income-tax-free to your beneficiaries, making IUL an effective estate planning tool. You get the benefits without the burden of income taxes.

When Taxes Come Into Play

Even the best financial tools come with some fine print. An IUL is no exception. If you take out more than what you’ve paid in premiums, the extra amount is subject to income tax. So, if you’ve been planning to take out a big loan, be ready for a portion to go to the IRS.

If you decide to surrender your policy fully, any earnings above what you’ve paid in premiums will also be taxed as income. It’s like breaking open your piggy bank, but instead of just a reward, the IRS takes its share—one of those “gotcha” moments.

Another potential tax trigger? If your policy lapses and you have an outstanding loan, the IRS may treat the loan balance as taxable income, leaving you with a surprise tax bill. While IULs offer great benefits, be aware of the potential tax issues and consult a professional to work through them.

IUL vs. Traditional Retirement Accounts

One of the key advantages of an IUL over traditional retirement accounts is the lack of required minimum distributions. With a 401(k) or IRA plan, the IRS typically mandates you start withdrawing at age 72 or 73. But with an IUL, you can let your money continue to grow without the pressure to take it out, especially helpful as you navigate IUL estate planning.

For high earners who can’t contribute to a Roth IRA due to income limits, an IUL can be a great workaround. You can still build tax-free income later in life without running into those restrictions.

Plus, while traditional accounts can be vulnerable to market volatility, IULs offer more stability. Your cash value grows based on a stock market index (like the S&P 500), but there’s a 0% floor in place to protect against losses due to market volatility. While your policy may still incur costs during down years, you won’t lose anything due to market downturns. That means you won’t wake up to a devastating drop in your retirement savings, making it a safer option for some.

Keeping the IRS Happy

Nobody likes a surprise tax bill, especially when it could have been avoided with some planning. To keep your IUL tax-friendly, working with a financial advisor or tax specialist is key. These experts can guide you through the nuances of your policy and help you avoid common mistakes that could trigger taxes.

When it comes to taxable events, like making a withdrawal or surrendering your policy, report them correctly. These actions require filing the correct forms with the IRS to stay compliant. Getting this wrong could mean owing more than you expected.

If you’ve taken a loan from your IUL, avoid letting your policy lapse. An outstanding loan combined with a lapsed policy can trigger a taxable event, leaving you with a hefty tax bill. Keeping your policy funded and making timely premium payments helps protect you from these unexpected costs.

By staying proactive and informed, you can enjoy the tax benefits of your IUL without unwanted surprises.

Use IUL Wisely

Using an IUL wisely can keep taxes low and help build wealth more tax-efficiently. With its tax-deferred growth and income-tax-free death benefit, IUL is a powerful tool for those looking to grow their money while minimizing tax impact.

Of course, there are some potential pitfalls, so it’s essential to understand how the IRS treats your IUL. If this sounds like a strategy worth exploring, talk to a Utah IUL consultant who can help tailor an IUL policy that fits your financial goals.

Video

Infographic

Indexed Universal Life (IUL) insurance is a strategic way to grow wealth with minimal tax impact. It provides life insurance protection while allowing your cash value to accumulate tax-deferred. Check out this infographic to learn how to plan for a tax-free retirement with IUL.