Indexed universal life (IUL) insurance—have you heard of it? If not, you’re not alone. It’s one of financial planning’s most undiscovered secrets and, for some, the ultimate “why didn’t I know about this sooner?” moment.

When it comes to financial strategies, knowing the indexed universal life insurance pros and cons could be the game-changer you didn’t realize you needed. But it’s certainly the road less traveled, so why should you take it?

Today, we’ll discuss IUL, unpack why this option isn’t on everyone’s radar, and show you how giving it a chance might help lead you to a brighter future.

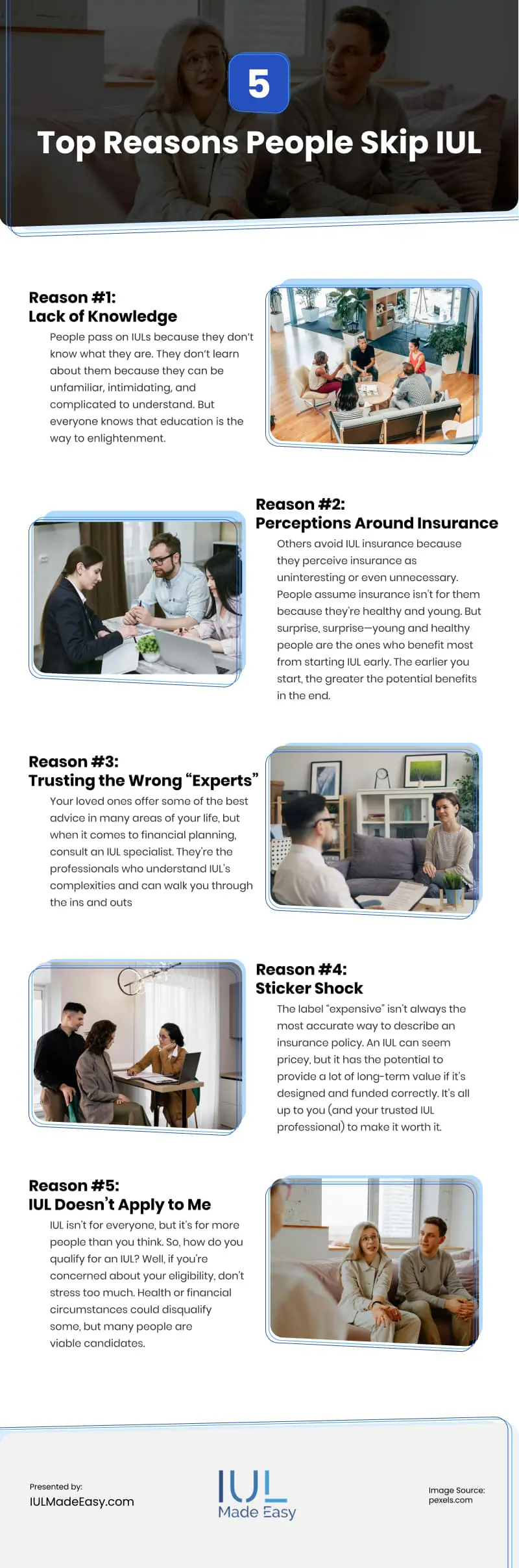

Reason #1: Lack of Knowledge

People pass on IULs because they don’t know what they are. They don’t learn about them because they can be unfamiliar, intimidating, and complicated to understand.

But everyone knows that education is the way to enlightenment. Just think of how people learned about basic hygiene, like washing hands, revolutionizing public health and saving countless lives. Investing some time into financially educating yourself could be life-changing, too.

You may find that IUL outshines conventional savings options like 401(k)s and IRAs. That’s because it offers nearly tax-free growth, flexibility in funds access, and solid protection from massive market downturns.

Reason #2: Perceptions Around Insurance

Others avoid IUL insurance because they perceive insurance as uninteresting or even unnecessary.

People assume insurance isn’t for them because they’re healthy and young. But surprise, surprise—young and healthy people are the ones who benefit most from starting IUL early. The earlier you start, the greater the potential benefits in the end.

And yes—sometimes, insurance is a bit dull. It’s not something most people discuss on a raging night out with friends. But that doesn’t diminish its importance. When something unexpected happens to you or a loved one, insurance offers the peace of mind that you’re set up to be alright, at least financially.

Life insurance gets a bad rap. It’s like the vegetables on your financial planning dinner plate. You might not enjoy eating them, but they’ll help to keep you healthy and strong.

Reason #3: Trusting the Wrong “Experts”

Some keep IUL insurance at arm’s length because they’ve gotten bad advice or listened to unlikely, fear-inducing tales from others. Friends, family, or unqualified advisors may steer you from IUL out of ignorance.

Your loved ones offer some of the best advice in many areas of your life, but when it comes to financial planning, consult an IUL specialist. They’re the professionals who understand IUL’s complexities and can walk you through the ins and outs. Not sure how to find a trusted advisor? A quick search for “IUL professionals near me” can get you started.

Listening to your cousin’s tax advice is like letting someone with their eyes closed navigate your road trip. It’s a recipe for confusion that could lead to a lifetime of regret.

Reason #4: Sticker Shock

The label “expensive” isn’t always the most accurate way to describe an insurance policy. An IUL can seem pricey, but it has the potential to provide a lot of long-term value if it’s designed and funded correctly. It’s all up to you (and your trusted IUL professional) to make it worth it.

You might pay more fees than a traditional life insurance policy, but think of what you get in return. You have a 0% floor, which protects you from major losses due to market volatility during down years in the market. You have a death benefit and a cash component, which offer much more value than either a traditional life insurance policy or a savings account. And you also have the option to become your own bank. So, while the price upfront might be more, you’re receiving more value from it, too.

Reason #5: IUL Doesn’t Apply to Me

IUL isn’t for everyone, but it’s for more people than you think. So, how do you qualify for an IUL? Well, if you’re concerned about your eligibility, don’t stress too much. Health or financial circumstances could disqualify some, but many people are viable candidates.

Even if you have pre-existing health conditions or modest means, you can benefit if you meet the minimum savings thresholds required. Don’t just assume you’re disqualified because of some criteria that’s been an issue in the past. With IUL, there’s plenty of room at the party.

What You’ll Miss if You Skip IUL

Look, IUL isn’t going to make you a millionaire in a year, but that’s the point. Many people seek short-term gains as a product of the instant gratification mindset of the modern world, but that undermines long-term planning. Quick wins are usually tax-heavy and inconsistent—compare that to IUL’s potential for much more stable growth.

IUL typically offers its users greater financial security and long-term peace of mind with loved ones supported by the death benefit. In 10 years, skipping IUL may feel like not buying Bitcoin in 2015—missing out on a financial jackpot.

So, don’t dismiss IUL out of fear, misinformation, or short-term thinking. Talk to an expert today to get informed and find out how IUL aligns with your life goals. Your future self is thanking you in advance for making the smart move.

Video

Infographic

Understanding the pros and cons of indexed universal life insurance (IUL) could be a game-changer for your financial strategy. This infographic explains why IUL might not be on everyone’s radar and how it can lead to a brighter financial future.