Indexed universal life insurance (IUL) is more than just a safeguard for your loved ones. It’s a dynamic financial tool that combines life insurance protection with the potential for cash value growth.

Think of your IUL like a nest egg with wings—it’s there to protect your future and grow over time, and it can give you a lift when life takes a tricky turn. This makes IUL estate planning a powerful way to enhance your financial flexibility.

By wisely accessing your IUL cash value by taking out a loan and using the value of the policy as collateral, you can confidently navigate life’s financial twists and turns. You could make the most of your hard-earned money and turn your policy into a valuable asset that lasts for years.

What Is Cash Value and Why Is It Important?

The cash value of your IUL can earn interest over time, linked to the performance of a market index like the S&P 500. Then, the growth is compounded within the policy to build the cash value available to you.

Why should you care? Well, unlike regular life insurance, the cash value in your IUL could provide unique financial opportunities, like paying for a big event or funding part of your retirement.

It’s sort of like having a savings account that could grow faster when the market does well—minus the rollercoaster ride of volatile full market exposure.

How to Access Your Cash Value

You’re wondering, “Is the money I take out of my IUL policy tax-free?” Understanding how the IRS sees the way you access money with your policy can save you more than tax headaches—it can mean more cash for you, accumulating where it counts.

Policy Loans

Now the question comes: “How do IUL loans work?” Here’s your answer.

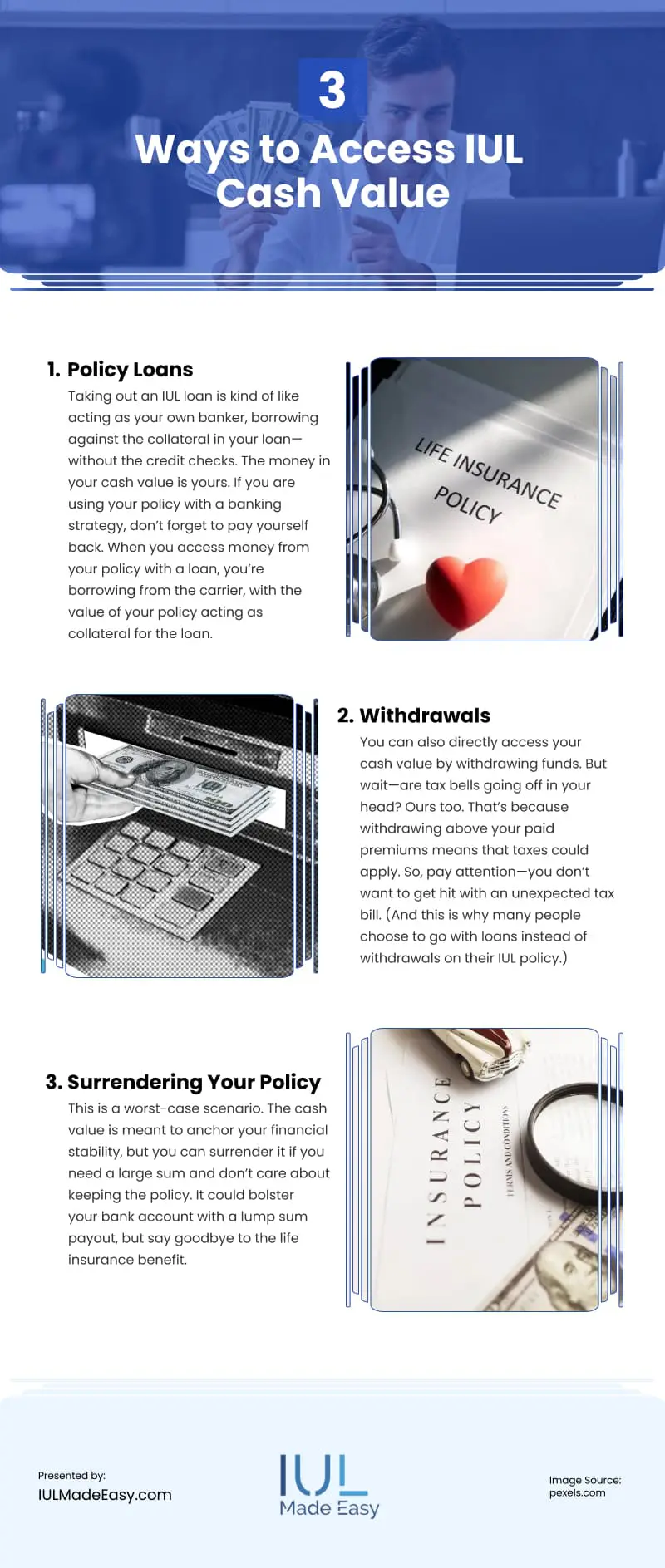

Taking out an IUL loan is kind of like acting as your own banker, borrowing against the collateral in your loan—without the credit checks. The money in your cash value is yours. If you are using your policy with a banking strategy, don’t forget to pay yourself back.

When you access money from your policy with a loan, you’re borrowing from the carrier, with the value of your policy acting as collateral for the loan.

You can choose to repay the loan–and if so, policy loans offer a flexible repayment schedule that can be super helpful in financially tight times. While the loans are tax-free, your loan balance can become taxable if the policy lapses.

If you choose to not repay the loan, any unpaid loans will simply reduce the death benefit upon your passing, along with the interest charged, so keep that in mind when considering how your loans will impact the death benefit that will go to your heirs.

Withdrawals

You can also directly access your cash value by withdrawing funds. But wait—are tax bells going off in your head? Ours too. That’s because withdrawing above your paid premiums means that taxes could apply. So, pay attention—you don’t want to get hit with an unexpected tax bill. (And this is why many people choose to go with loans instead of withdrawals on their IUL policy.)

Withdrawing from your cash value could fuel major purchases by providing instant access and no-interest payments. It may be the perfect move for a rainy day, but don’t go too crazy with withdrawals—you’re still borrowing from your future, after all.

Surrendering Your Policy

This is a worst-case scenario. The cash value is meant to anchor your financial stability, but you can surrender it if you need a large sum and don’t care about keeping the policy. It could bolster your bank account with a lump sum payout, but say goodbye to the life insurance benefit.

Beware: when surrendering the policy, any gain from the cash value will be taxed, and you may have to pay surrender fees. It’s like trying to cash out a winning lottery ticket but getting taxed heavily on the prize.

Best Practices for Accessing Your IUL Cash Value

First, borrow from your IUL strategically, not willy-nilly. Planning the use of your funds can empower you to save your cash value for major expenses or to supplement your retirement income. But remember that you’ll want to repay loans if you don’t want to reduce your policy’s death benefit.

Taking small, tax-efficient sums out is also best—ideally, only the premiums you’ve already paid. Harnessing your IUL’s potential as an emergency fund is great, but leave it in good shape afterward.

Finally, monitor the costs of your policy on your annual statements, as they can rise. It’s important to understand the right timing for minimizing your death benefit and managing your policy to maximize the returns.

Tapping into your IUL’s value shouldn’t feel like emptying your pockets. With a steady hand, financial flexibility can work wonders without sacrificing your entire policy’s integrity.

As you can see, while powerful, IULs can be complex. This is why it’s so significant to work with an IUL professional who understands all of these nuances.

Maximizing Your IUL

Unlocking the cash value of your IUL doesn’t have to mean compromising your future. From flexible policy loans to strategic use of your funds, you can make the most of your policy today and for years while preserving its long-term benefits.

The key is planning wisely—know your options, manage potential tax implications, and stay proactive. Utah IUL consultants can guide you through the process, helping you tailor a strategy that fits your goals.

Letting this financial goldmine go untapped is like being handed the keys to a treasure chest but never opening it. Learn more today to make your IUL work for you now and in the years ahead.

Video

Infographic

Enhance your finances by leveraging the cash value of your Indexed Universal Life (IUL) policy. Understanding IRS treatment of these withdrawals can help you avoid tax complications and retain more cash. Find out in this infographic how to access your cash value.