Imagine you had a savings account that earns interest based on the stock market, but without actually risking your money in the market.

Sounds like a win-win, right?

Indexed Universal Life (IUL) policies can do just that. One of the great things about IULs is how they protect your gains and help you get the best returns. This is thanks to two key features: lock-in and reset. These mechanisms make sure you can keep the money you earn, even if the market goes down later, and set you up for the best possible growth.

Understanding these features is your key to maximizing the potential of an IUL policy. This article breaks down how lock-in and reset work, their benefits, and how they impact your financial strategy. Whether you are considering an IUL for retirement or already have one, knowing how these features function will help you make the most of this powerful financial tool.

What Is a Lock-In Feature in an IUL Policy?

Lock-in is one of the most appealing features of an Indexed Universal Life insurance policy. It guarantees that once your policy earns interest from the market’s performance, those gains are secured, protecting them from any future market downturns.

How Does Lock-In Work?

- Annual Interest Crediting: Every year, your policy has a “crediting period” where it earns interest based on how well a market index, like the S&P 500, performs. A crediting period is simply the amount of time the insurance company uses to determine how much interest your policy earns. At the end of the year, the insurance company figures out how much interest your policy has earned.

- Interest Becomes Permanent: Once the interest is earned, it’s locked in. So even if the market drops later, you won’t lose those gains. For example, if your policy earned 5 percent this year, that 5 percent is yours to keep, no matter what happens in the market afterward.

- Compounding Effect: Each year, those locked-in gains get added to your policy’s cash value, and they keep earning interest in future years. Think of it like a snowball effect—the more it grows, the more it can continue to grow.

If an IUL policy gains 8 percent in one year, it permanently locks in that 8 percent increase. If the following year, the market declines by 10 percent, you wouldn’t lose the previously earned gains. Instead, you begin the new period with the full amount you had before, so you’re protected from any market losses.

The most amazing thing about this scenario is that even though the market went down 10%, you didn’t lose principle because of the market. Keeping you safe from market risk.

What Is a Reset Feature in an IUL Policy?

Reset is like hitting the “refresh” button on your IUL policy each year. At the end of the year, the policy looks at the market’s performance and sets a new starting point, which determines how much your policy can grow in the next cycle.

How Does Reset Work?

- New Starting Point Every Year: At the end of each crediting period, the market index value becomes the new starting point for calculating future growth.

- Captures Market Gains: As the policyholder, you always benefit from index increases from the new reset point, even if the previous year saw a decline.

- Helps Recover from Losses: If the market dropped the year before, the reset feature makes sure that future growth starts from the lower value, giving your policy a chance to bounce back faster and start growing again.

Let’s say your IUL policy follows the S&P 500, and at the end of the year, the index is at 4,000 points. That 4,000 points becomes the new starting point for the next year. Even if the market went down last year, any increase from this new starting point will be credited to your policy, so you can start fresh without worrying about past losses.

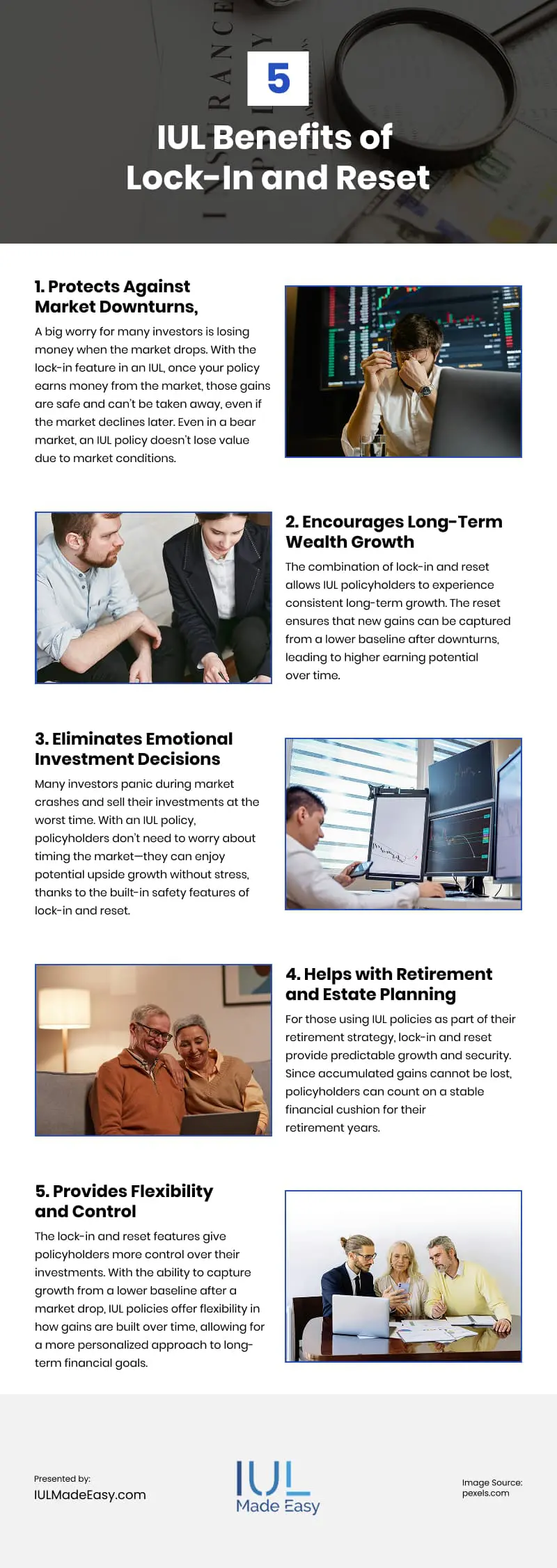

5 Lock-In and Reset Benefits

1. Protects Against Market Downturns

A big worry for many investors is losing money when the market drops. With the lock-in feature in an IUL, once your policy earns money from the market, those gains are safe and can’t be taken away, even if the market declines later. Even in a bear market, an IUL policy doesn’t lose value due to market conditions.

2. Encourages Long-Term Wealth Growth

The combination of lock-in and reset allows IUL policyholders to experience consistent long-term growth. The reset ensures that new gains can be captured from a lower baseline after downturns, leading to higher earning potential over time.

3. Eliminates Emotional Investment Decisions

Many investors panic during market crashes and sell their investments at the worst time. With an IUL policy, policyholders don’t need to worry about timing the market—they can enjoy potential upside growth without stress, thanks to the built-in safety features of lock-in and reset.

4. Helps with Retirement and Estate Planning

For those using IUL policies as part of their retirement strategy, lock-in and reset provide predictable growth and security. Since accumulated gains cannot be lost, policyholders can count on a stable financial cushion for their retirement years.

5. Provides Flexibility and Control

The lock-in and reset features give policyholders more control over their investments. With the ability to capture growth from a lower baseline after a market drop, IUL policies offer flexibility in how gains are built over time, allowing for a more personalized approach to long-term financial goals.

Lock-In and Reset vs. Traditional Market Investments

This comparison highlights why many investors incorporate IUL policies for retirement into their long-term financial strategies. Unlike traditional market investments, IUL policies offer security and tax advantages, making them an attractive option for risk-averse individuals.

| Feature | Indexed Universal Life (IUL) | Traditional Stock Market Investments |

| Market Loss Protection | Yes, gains are locked in | No, investments can lose value |

| Annual Reset Feature | Yes, growth measured from a new baseline | No, past losses carry forward |

| Tax Advantages | Tax-free growth and withdrawals | Subject to capital gains and income tax |

| Liquidity | You can take out loans against the policy value | Subject to market conditions and penalties |

Key Considerations When Using an IUL Policy

While lock-in and reset provide significant benefits, policyholders should also consider the following:

- Cap Rates and Participation Rates: Most IUL policies have limits on how much of the market gains they credit to policyholders. Understand these caps when choosing an IUL policy.

- Policy Fees and Costs: Like any insurance, IUL policies have some fees, such as administrative and life insurance charges. You should make sure the potential benefits outweigh these costs.

- Long-Term Commitment: IULs are long-term financial tools that may not be suitable for short-term financial needs.

Consulting with a financial professional ensures that your IUL policy aligns with your financial objectives.

Find an IUL Expert Today

Indexed Universal Life (IUL) policies offer secure, flexible growth with protection from market downturns. The lock-in feature makes gains permanent, while the reset ensures that future growth starts fresh after a decline.

An IUL can provide tax-advantaged growth, long-term security, and a safeguard against market crashes. For those looking to build wealth with low risk, understanding the lock-in and reset features can make a big difference.

If you’re considering an IUL, reach out to an IUL Made Easy advisor to ensure you’re maximizing its benefits as part of your overall financial plan.

Video

Infographic

One of the key benefits of IUL is its ability to protect your earnings and maximize returns through two features: lock-in and reset. These ensure you retain your gains even if the market declines, helping you achieve optimal growth. Learn more about these advantages in this infographic.