When you hear about Indexed Universal Life Insurance, or IUL, you might think it sounds confusing, risky, or even a little too good to be true. And if you’ve Googled it or asked around, you’ve probably seen a mix of strong opinions.

The truth? IULs are often misunderstood, and that confusion can lead people to miss out on a potentially powerful financial tool.

You don’t need to be a financial expert to understand how IULs work—you just need a clear explanation. So let’s break down some of the most common myths and give you the real story.

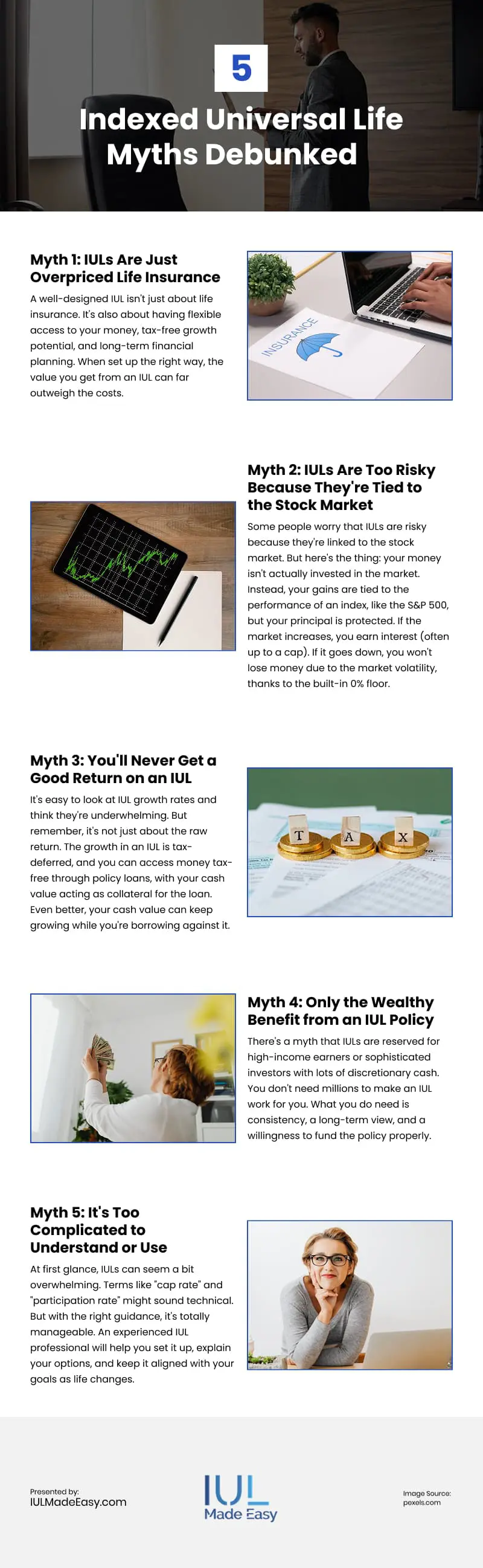

Myth 1: IULs Are Just Overpriced Life Insurance

Many people assume that IULs are just expensive versions of regular life insurance. Yes, fees are involved, like insurance costs and administrative charges, but there’s more to the story.

A well-designed IUL isn’t just about life insurance. It’s also about having flexible access to your money, tax-free growth potential, and long-term financial planning. When set up the right way, the value you get from an IUL can far outweigh the costs.

Think of an IUL like a high-end car. It might seem expensive at first, but when you consider the performance, comfort, and long-term value, the price makes a lot more sense.

Myth 2: IULs Are Too Risky Because They’re Tied to the Stock Market

Some people worry that IULs are risky because they’re linked to the stock market. But here’s the thing: your money isn’t actually invested in the market.

Instead, your gains are tied to the performance of an index, like the S&P 500, but your principal is protected. If the market increases, you earn interest (often up to a cap). If it goes down, you won’t lose money due to the market volatility, thanks to the built-in 0% floor.

So, while with most capped indexes you won’t see some of the highest stock-market-level returns, you also won’t take stock-market-level hits. If you like the idea of steady, protected growth, this setup might be exactly what you’re looking for.

Myth 3: You’ll Never Get a Good Return on an IUL

It’s easy to look at IUL growth rates and think they’re underwhelming. But remember, it’s not just about the raw return. The growth in an IUL is tax-deferred, and you can access money tax-free through policy loans, with your cash value acting as collateral for the loan. Even better, your cash value can keep growing while you’re borrowing against it. Over time, this creates powerful compounding that traditional investments can’t always match, especially when you factor in no taxes and no market losses.

So while a 6% average return may not sound exciting next to stocks, the way that return works makes a big difference over time.

Myth 4: Only the Wealthy Benefit from an IUL Policy

There’s a myth that IULs are reserved for high-income earners or sophisticated investors with lots of discretionary cash. But the reality is that IULs can benefit almost anyone, especially those who want a more flexible and secure financial future.

You don’t need millions to make an IUL work for you. What you do need is consistency, a long-term view, and a willingness to fund the policy properly. If you’re someone who wants a better alternative to a traditional savings account, a tax-efficient way to grow wealth, or a backup source of tax-free income for retirement or emergencies, an IUL can be a powerful tool regardless of your income level.

Many people use their IUL for a retirement supplement, a college funding strategy, or even as an emergency fund. And because the policy offers flexible premiums, you can scale your contributions based on your current financial situation and future goals.

Myth 5: It’s Too Complicated to Understand or Use

At first glance, IULs can seem a bit overwhelming. Terms like “cap rate” and “participation rate” might sound technical. But with the right guidance, it’s totally manageable.

You don’t need to understand every fine detail; you just need to know how your policy works and how to use it. An experienced IUL professional will help you set it up, explain your options, and keep it aligned with your goals as life changes.

It’s kind of like learning to drive. It feels complicated at first, but once you get the hang of it, it becomes second nature. The same applies to managing your IUL. You don’t need to master every detail, just the ones that matter most to your goals.

The Real Value of an IUL Once You Understand It

When you peel back the myths and focus on the fundamentals, an Indexed Universal Life insurance policy starts to look a lot less mysterious and a lot more strategic. You’re not just buying a life insurance policy; you’re securing a tool that can provide tax-advantaged growth, protect your wealth, and offer financial flexibility at every stage of your life.

If you’re building a financial plan that prioritizes longevity, liquidity, and legacy, an IUL can be a cornerstone asset that quietly does a lot of the heavy lifting behind the scenes. It won’t necessarily replace your investment accounts, but it can be an invaluable part of your financial portfolio, offering balance and protection when the unexpected hits or when opportunity knocks.

If you want to take control of your financial future, don’t let misconceptions steer you away from a policy that might offer exactly what you need. Get the facts, ask the questions, and work with a knowledgeable advisor who can tailor your IUL strategy to your goals and walk you through how to get an IUL policy. The result? A plan you understand, a tool you can use, and confidence in what your money is doing for you, today and tomorrow.

Video

Infographic

Indexed Universal Life Insurance (IUL) is often misunderstood, drawing criticism based on myths and misconceptions. When properly explained, however, it can be a powerful asset in long-term financial planning. This infographic debunks common IUL myths and clarifies its potential benefits.