Indexed universal life insurance. It’s like a sleek, high-performance sports car, capable of driving you toward your financial goals and offering the safety you need.

But just like that sports car, an IUL needs careful management to keep it running smoothly. Neglect the maintenance, and you could find yourself stranded.

IUL combines life insurance with the potential for cash value growth that’s tied to a market index. But surely, something could go terribly wrong. So, is IUL a good investment?

Don’t worry; we’ve got your back. Let’s explore what mistakes to avoid with an IUL and how to stay on the road to success.

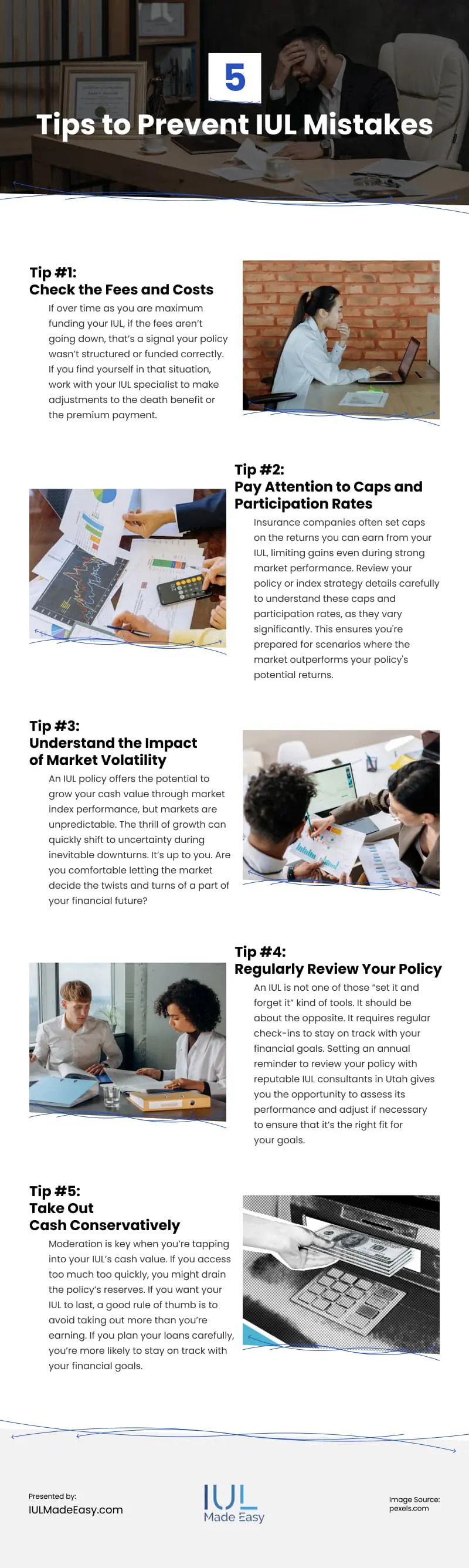

Tip #1: Check the Fees and Costs

While they’re typically gentler than traditional finance fees, the charges in an IUL policy can significantly impact its performance and eat away at your policy’s cash value over time.

These costs could include mortality charges (which provide the death benefit), surrender penalties (in case you decide to cancel your policy early), or administrative fees (for record-keeping, processing, etc.).

If over time as you are maximum funding your IUL, if the fees aren’t going down, that’s a signal your policy wasn’t structured or funded correctly. If you find yourself in that situation, work with your IUL specialist to make adjustments to the death benefit or the premium payment.

Tip #2: Pay Attention to Caps and Participation Rates

Yes, the IUL fund can grow as it tracks a stock index, but sadly, the returns aren’t unlimited. Depending on the index strategies you choose, insurance companies often place caps on the maximum return you can earn from your IUL. So even if the market soars a mile high, your gains will probably hit a ceiling.

And the insurance company’s participation rates decide the percentage of the stock index’s growth that will actually get credited to your policy in the end. You may not receive the full amount that’s reflective of the stock index. For example, a participation rate of 85% means you’ll only receive 85% of the stock index’s performance.

Review your IUL policy to identify these limits, or read through policy and/or index strategy details carefully to make sure you’re choosing what you want. Participation rates and caps can vary greatly, and understanding yours prepares you for times when the market performs well but your policy may not.

Tip #3: Understand the Impact of Market Volatility

One of the biggest benefits of an IUL insurance policy is its ability to grow your cash value through market index performance. But if you know anything about the markets, it’s that they are always fluctuating.

Just think of it: a particularly strong year could boast some impressive gains in your policy, but a downturn could leave your account growth flat. An IUL includes a 0% floor that helps protect your cash value against market volatility, but you are still subject to fees that can leave you in the negative in a particularly bad market year.

The market can be like a roller coaster—but you’re on it blindfolded. The thrill of your cash value climbing higher and higher can quickly turn into fear when you hit those inevitable drops.

This is where those market caps have their angelic counterpart. The caps allow carriers to give you that 0% floor when the markets take a dive, so you have peace of mind even during economic storms.

It’s up to you. Are you comfortable letting the market decide the twists and turns of a part of your financial future?

Tip #4: Regularly Review Your Policy

An IUL is not one of those “set it and forget it” kind of tools. It should be about the opposite. It requires regular check-ins to stay on track with your financial goals.

Your life will change year to year, the market conditions will shift, and your financial priorities might even evolve over time. That means that without those periodic reviews, you could veer off course or find yourself with unwelcome surprises like fees or low cash value growth.

Setting an annual reminder to review your policy with reputable IUL consultants in Utah gives you the opportunity to assess its performance and adjust if necessary to ensure that it’s the right fit for your goals.

Tip #5: Take Out Cash Conservatively

Moderation is key when you’re tapping into your IUL’s cash value. If you access too much too quickly, you might drain the policy’s reserves. That slows down its long-term growth. It’s tempting to think of that cash as an easy-access fund, but it’s more like a long-term relationship than a summer fling.

If you want your IUL to last, a good rule of thumb is to avoid taking out more than you’re earning. If you plan your loans carefully, you’re more likely to stay on track with your financial goals.

Closing It Up

An indexed universal life insurance policy has the potential to change the landscape of your finances. But just like your favorite house plant, your IUL needs regular care and attention.

Staying proactive by monitoring its details, making adjustments, and addressing issues quickly sets you up to live with a policy that aligns with your needs and hopes. Neglect your IUL, and you might find it wilting away when you need it most.

But if you nurture the growth of your IUL, you’ll probably see it flourish.

Infographic

Indexed universal life insurance (IUL) is like a high-performance sports car—it can drive you toward your financial goals while offering safety. However, it requires careful management; neglect can leave you stranded. Check out this infographic to learn about common mistakes to avoid with an IUL.