If you’re planning for long-term financial flexibility and future income, you’ve probably looked into opening a Roth IRA. And for good reason. Roth IRAs offer tax-free qualified withdrawals and strong growth potential over time. But what if there were another option that provided similar tax advantages, with added flexibility, liquidity, and protection from market losses?

That’s where an IUL LASER Fund comes in.

A LASER Fund, short for Liquid Assets Safely Earning Returns, is a specially designed Indexed Universal Life (IUL) insurance policy built to grow cash value, offer easy tax-free access to your money, and provide your income-tax-free death benefit. While it’s not a one-to-one replacement for a Roth IRA, it can support many of the same goals, typically with even more strategic advantages.

In this guide, we’ll explore how an IUL LASER Fund works, how it compares to a Roth IRA, and why it might be a smart addition to your overall financial strategy.

Understanding the Basics: IUL LASER Fund vs. Roth IRA

A Roth IRA lets you contribute after-tax income, grow your investments tax-free, and typically withdraw funds penalty-free and tax-free after age 59½, making it a smart choice if you expect to be in a higher tax bracket later in life. However, there are limitations: Roth IRAs have annual contribution caps, income eligibility rules, and early withdrawal penalties unless certain exceptions apply.

An IUL LASER Fund, on the other hand, isn’t a retirement account—it’s a life insurance policy designed to build cash value over time. You fund it with more than just the minimum premium, and the cash value grows based on the performance of a market index (like the S&P 500), but without being directly invested in it. While the growth isn’t guaranteed, you’re protected by a 0% floor, meaning you won’t lose value due to market drops, though policy fees can still reduce your balance in low-performing years.

One of the biggest advantages is flexibility. The cash value in your LASER Fund can be accessed through tax-free policy loans, and unlike a Roth IRA, there are no contribution limits, early withdrawal penalties, or required minimum distributions.

In short, while both strategies offer tax advantages, a LASER Fund gives you more freedom in how and when you use your money, making it a powerful complement to traditional retirement accounts.

Here are five ways a LASER Fund gives you the flexibility you want, where a Roth IRA doesn’t.

1. Funding Flexibility and No Income Limits

One of the biggest frustrations you might face with a Roth IRA is that income limits restrict who can contribute directly. If you earn too much, you either have to jump through hoops with a backdoor Roth conversion or settle for other, less efficient options. On top of that, annual contribution limits cap how much you can put into your account each year.

With a LASER Fund, there are no income restrictions and no IRS-imposed caps on how much you can fund, so long as you stay within guidelines that prevent the policy from becoming a Modified Endowment Contract (MEC). This gives you the freedom to maximize the cash value accumulation in a way that aligns with your goals, timeline, and income level.

Imagine you’re in your 40s with extra capital and want to build long-term tax-advantaged income access. A LASER Fund lets you put in more than the current $7,000 per year limit on a Roth IRA (for those over 50) and potentially build a larger reserve without jumping through legal or tax hurdles.

2. Tax-Advantaged Access to Income Without Penalties

A Roth IRA’s rules require you to wait until age 59½ to access your funds without penalties, unless you qualify for certain exceptions. Even then, there are rules about how long your account must have been open before you can withdraw earnings tax-free.

With a LASER Fund, you don’t face those same age-based restrictions. You can access your policy’s cash value at any age through tax-free loans, as long as the policy is properly structured and stays in force. These loans are secured by the policy’s cash value, and the balance is simply deducted from your income-tax-free death benefit if not repaid.

That means whether you’re planning to access your tax-free funds in your 40s, need a source of tax-free cash for a business opportunity in your 50s, or want tax-free supplemental retirement income in your 60s, the LASER Fund gives you flexibility without early withdrawal penalties or forced distributions.

3. Protection From Market Volatility

Roth IRAs are directly invested in the market, which means your returns—and your risk—rise and fall with market performance. In a down year, your account value can take a significant hit, potentially right when you need the money most.

A LASER Fund works differently. Your cash value isn’t directly invested in the stock market. Instead, it’s linked to the performance of an index like the S&P 500. This setup gives you the opportunity to benefit from market gains, while a built-in 0% floor helps protect you during market downturns. In other words, if the index performs poorly, you won’t earn interest, but you won’t lose value due to market losses.

That said, it’s not entirely risk-free. Policy fees still apply, even in flat or negative years, which means your cash value can still decline despite the floor. So while a LASER Fund can offer more stability than traditional market investments, it’s important to understand that it doesn’t eliminate risk altogether.

4. Estate Planning and Legacy Benefits

While your Roth IRA can pass to your heirs without triggering immediate income tax, it doesn’t have a built-in death benefit. A LASER Fund does. In addition to building cash value, it provides an income-tax-free death benefit designed to give your beneficiaries a financial payout, not just whatever cash is left in the account.

Remember, this death benefit may still be subject to estate tax if your total estate value exceeds the exemption limit, so it’s important to factor it into your overall estate planning strategy.

This makes the LASER Fund a powerful dual-purpose tool: It offers access to tax-free income while you’re alive, and leaves behind a meaningful income-tax-free legacy for your loved ones—even if you’ve borrowed against the cash value along the way.

5. Greater Control Over Policy Management

With a Roth IRA, your withdrawals are governed by IRS rules, including penalties for early or non-qualified distributions. This can limit your flexibility when you want to access funds or adjust your strategy. And while you are not subject to required minimum distributions, your heirs will be.

A LASER Fund, being a life insurance policy, offers more control over how and when you access your cash value through policy loans, withdrawals, or adjusting premiums and riders. You and your heirs are not locked into government-mandated distribution schedules; your advisor can help tailor your policy management to evolving financial goals and life changes.

This flexibility can be especially valuable if you want to optimize income timing, legacy planning, or adapt to unexpected financial needs without triggering penalties or tax events.

When to Consider a LASER Fund Alongside a Roth IRA

This doesn’t have to be an either-or decision. You can absolutely use both strategies together to build a more robust, diversified financial plan. A Roth IRA may be perfect for funding up to the contribution limit, while a LASER Fund gives you more flexibility with larger contributions, easy access, and death benefit protection.

In fact, combining both can allow you to balance tax advantages, protect against market downturns, and create multiple streams of income for the future. A Roth can give you tax-free growth and tax-free income, but you’re exposed to market losses and contribution limits. A LASER Fund can give you tax-free growth and access to tax-free income, along with greater stability, liquidity, and the ability to set aside more with no annual contribution limits.

By layering these two tools, you build financial resilience, so you’re not dependent on one single account or strategy to carry your entire retirement or wealth-building plan.

A New Way To Reach Your Goals

A Roth IRA is a great option, but it’s not the only tool at your disposal. An IUL LASER Fund gives you the flexibility, tax efficiency, and protection that many people need, especially if you’re looking to contribute more, access your money earlier, or diversify against market volatility.

With no income limits, tax-advantaged access to income, and a death benefit that supports your family, the LASER Fund can do more than just supplement your Roth—it can help you build a brighter financial future with greater control and peace of mind.

If you’re ready to explore how a LASER Fund can complement or even outperform traditional strategies in your situation, reach out to a trusted Utah IUL professional. They’ll walk you through the structure, run personalized illustrations, and help you determine if this financial vehicle is the right fit for your long-term goals.

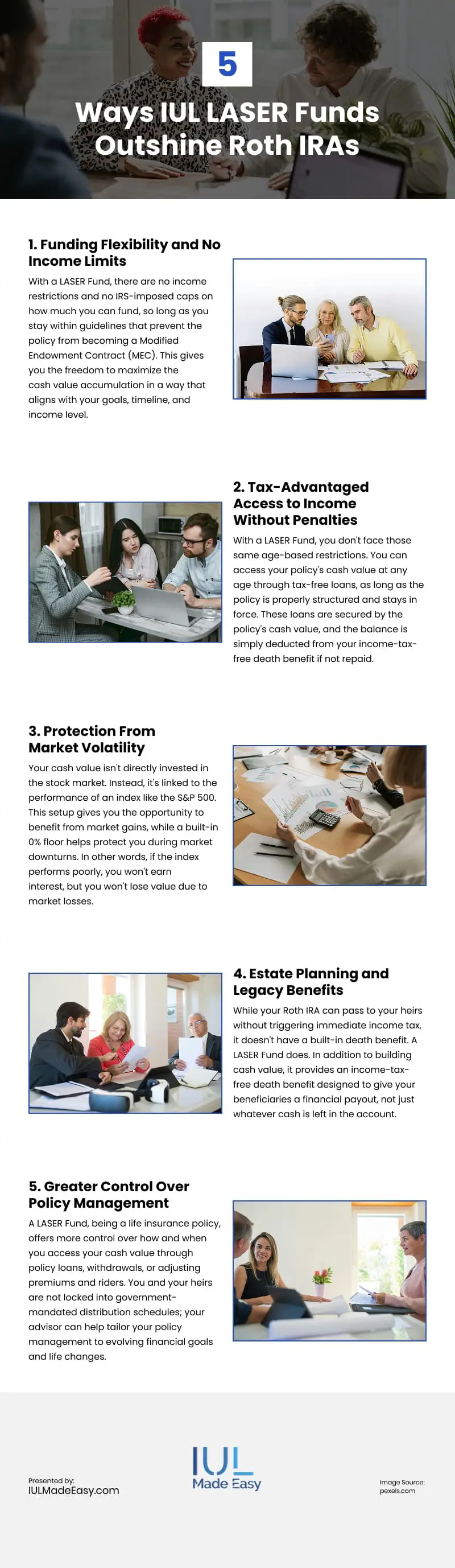

Infographic

A LASER Fund is a flexible Indexed Universal Life policy offering tax-free growth, accessible liquidity, and an income tax–free death benefit. It provides a unique alternative to traditional retirement plans, without exposing you to market risk. Discover more in this infographic.