As a self-employed professional, you already know that traditional financial tools don’t always fit your needs. Whether you’re running a small business, freelancing full-time, or building your brand from scratch, you face unique financial challenges—unpredictable income, limited access to employer-sponsored benefits, and the need for flexible financial strategies that grow with you.

That’s why many self-employed individuals like you are turning to properly structured, maximum-funded Indexed Universal Life (also called IUL LASER Funds) as a solution. These policies offer a rare blend of tax advantages, liquidity, and protection from market volatility, all wrapped into a strategy that you can customize based on your personal goals.

If you’re looking for more control, long-term benefits, and smarter ways to use your money without locking it up in less-flexible accounts, an IUL LASER Fund might be the right fit for your financial playbook. Here’s why more self-employed professionals are making the shift.

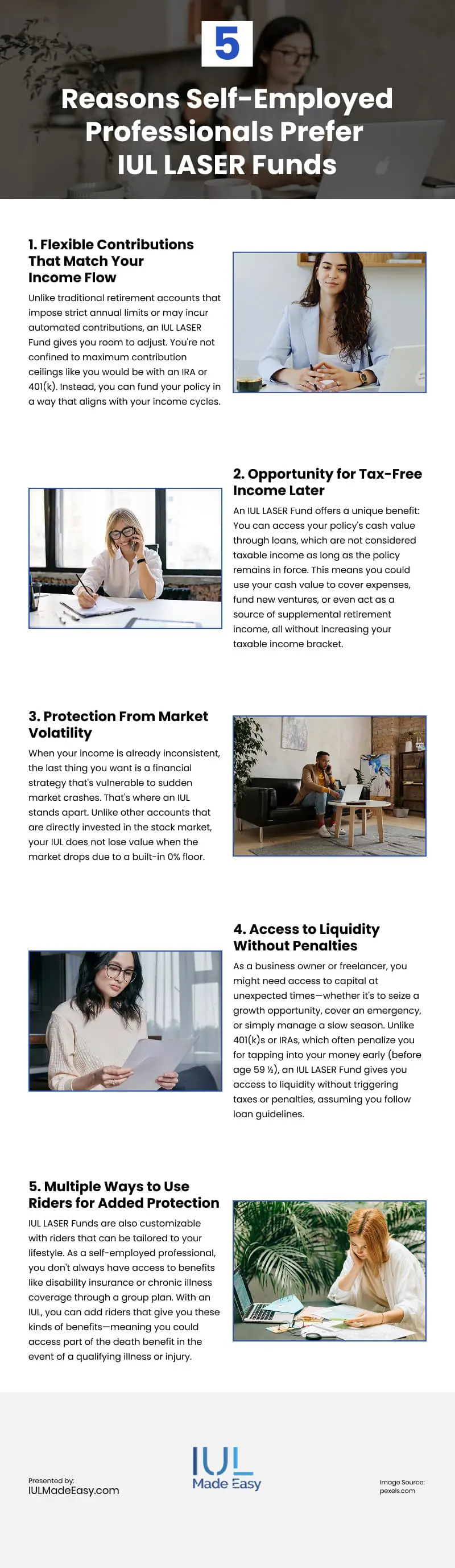

1. Flexible Contributions That Match Your Income Flow

Unlike traditional retirement accounts that impose strict annual limits or may incur automated contributions, an IUL LASER Fund gives you room to adjust. You’re not confined to maximum contribution ceilings like you would be with an IRA or 401(k). Instead, you can fund your policy in a way that aligns with your income cycles.

For example, if your business earns more revenue during certain months of the year, you can allocate more premium during those times and scale back when business is slower. As long as you stay within IRS guidelines for maximum funding without triggering a MEC (Modified Endowment Contract), you’re free to customize your strategy.

That kind of flexibility is crucial when you don’t have a predictable paycheck.

2. Opportunity for Tax-Free Income Later

As a self-employed person, you might not have access to a traditional pension or employer-matched retirement plan. So you need to find strategies that can supplement your retirement income, ideally without heavy taxation or early withdrawal penalties.

An IUL LASER Fund offers a unique benefit: You can access your policy’s cash value through loans, which are not considered taxable income as long as the policy remains in force. This means you could use your cash value to cover expenses, fund new ventures, or even act as a source of supplemental retirement income, all without increasing your taxable income bracket.

This makes IUL retirement especially appealing to self-employed professionals who want long-term growth potential without the restrictions of traditional plans.

Keep in mind that this isn’t the same as taking a withdrawal. Withdrawals can trigger tax consequences and reduce the value of your policy. But when you use a policy loan, you’re borrowing against the cash value with the expectation that the balance will eventually be deducted from the death benefit if it’s not repaid.

As long as the policy stays active, and you’re aware of how loans affect your policy’s long-term performance, you can unlock access to tax-free money in ways that traditional plans don’t allow.

3. Protection From Market Volatility

When your income is already inconsistent, the last thing you want is a financial strategy that’s vulnerable to sudden market crashes. That’s where an IUL stands apart. Unlike other accounts that are directly invested in the stock market, your IUL does not lose value when the market drops due to a built-in 0% floor.

That means during down years (especially those caused by market volatility), your cash value won’t lose money due to index declines. However, it’s important to note that fees are still deducted, so your account could show a decrease. But it won’t tank the way direct investments might.

This makes an IUL LASER Fund particularly appealing for self-employed professionals who don’t have the luxury of employer pensions or corporate safety nets. You get growth potential tied to a market index, often with a cap on maximum returns, but never exposed to full market risk.

4. Access to Liquidity Without Penalties

As a business owner or freelancer, you might need access to capital at unexpected times—whether it’s to seize a growth opportunity, cover an emergency, or simply manage a slow season. Unlike 401(k)s or IRAs, which often penalize you for tapping into your money early (before age 59 ½), an IUL LASER Fund gives you access to liquidity without triggering taxes or penalties, assuming you follow loan guidelines.

This makes it a valuable backup reserve. Think of it as a smart place to store capital that you want to keep growing but still have access to, if needed. If you structure your policy properly and avoid overloaning too early, you can leverage your cash value for tax-free loans while keeping your policy on track.

5. Multiple Ways to Use Riders for Added Protection

IUL LASER Funds are also customizable with riders that can be tailored to your lifestyle. As a self-employed professional, you don’t always have access to benefits like disability insurance or chronic illness coverage through a group plan. With an IUL, you can add riders that give you these kinds of benefits—meaning you could access part of the death benefit in the event of a qualifying illness or injury.

This helps fill the gap in your personal financial safety net. Riders can vary by provider, but common ones include:

- Chronic Illness Rider

- Critical Illness or Critical Injury Rider

- Terminal Illness Rider

- Waiver of Premium Rider (helps maintain the policy if you become disabled)

With these added layers, your IUL LASER Fund can be more than just a long-term cash strategy; it can be protection when life throws a curveball.

Extra Reason: Legacy Planning Without the Tax Burden

As a self-employed individual, you may be building something that you hope to pass on, whether that’s a business, a real estate portfolio, or simply a legacy of financial stability. An IUL policy helps ensure that when the time comes, your loved ones receive an income-tax-free death benefit.

If you have a large estate that exceeds the exemption, this death benefit may still be subject to estate taxes, but it avoids income taxes, unlike other financial accounts that can create taxable events for your heirs. So if leaving behind a financial cushion is part of your long-term vision, an IUL LASER Fund can help you build that with confidence.

A Tool Designed for Independent Earners Like You

The beauty of an IUL LASER Fund is in its flexibility and adaptability—two things you value as a self-employed professional. You’re not stuck with limited contributions or cash value losses due to unpredictable market downturns. Instead, you gain a financial vehicle that allows you the opportunity to grow wealth at a measured pace, access cash tax-free when needed, and prepare for both expected and unexpected moments in life.

Whether you’re aiming to fund future ventures, supplement your retirement income, or build a smarter safety net, IUL LASER Funds offer features that traditional tools often lack. But remember: The key is in the setup.

To get the most out of your IUL, work with a trusted expert who understands how to structure the policy to fit your lifestyle, income patterns, and long-term goals.

When designed properly, your IUL can become a powerful part of your financial strategy, helping you build a brighter future on your own terms.

Video

Infographic

Self-employed professionals require flexible financial solutions to accommodate their fluctuating incomes. More entrepreneurs are choosing the IUL LASER Fund to create long-term financial security without the limitations of traditional retirement accounts. Explore this infographic to learn why self-employed individuals prefer these funds.